Important MCA Announcement

The Ministry of Corporate Affairs has officially extended the deadline for filing DIR-3 KYC and DIR-3 KYC-WEB forms without fees until October 15, 2025. This extension provides additional time for directors to complete their KYC requirements.

The Ministry received numerous requests for an extension beyond the original September 30, 2025 deadline. After careful consideration, they have granted this extension to ensure all directors can comply without financial penalty.

Time Remaining to File Without Fees

Official MCA Circular

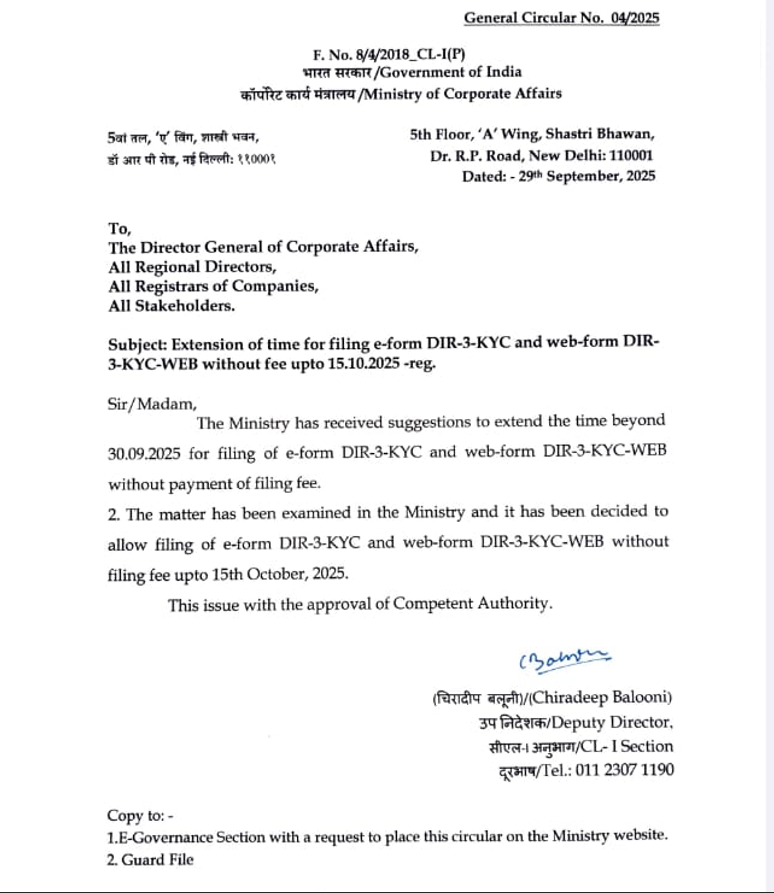

General Circular No. 04/2025

F. No. 8/4/2018_CL-I(P)

भारत सरकार / Government of India

कॉर्पोरेट कार्य मंत्रालय / Ministry of Corporate Affairs

5th Floor, 'A' Wing, Shastri Bhawan,

Dr. R.P. Road, New Delhi: 110001

Dated: - 29th September, 2025

To,

The Director General of Corporate Affairs,

All Regional Directors,

All Registrars of Companies,

All Stakeholders.

Subject: Extension of time for filing e-form DIR-3-KYC and web-form DIR-3-KYC-WEB without fee upto 15.10.2025 - reg.

Sir/Madam,

The Ministry has received suggestions to extend the time beyond 30.09.2025 for filing of e-form DIR-3-KYC and web-form DIR-3-KYC-WEB without payment of filing fee.

The matter has been examined in the Ministry and it has been decided to allow filing of e-form DIR-3-KYC and web-form DIR-3-KYC-WEB without filing fee upto 15th October, 2025.

This issue with the approval of Competent Authority.

(Signed)

(चिरदीप बलूनी) / (Chiradeep Balooni)

उप निदेशक / Deputy Director,

सीएल- I अनुभाग / CL-I Section

दूरभाष / Tel.: 011 2307 1190

Benefits of Filing Before Extended Deadline

Zero Filing Fees

Save on filing costs by completing your DIR-3 KYC before the October 15th deadline.

Avoid Penalties

Prevent late fees and potential DIN deactivation by filing within the extended timeline.

Stay Compliant

Maintain active director status and ensure uninterrupted business operations.

File Your DIR-3 KYC Before October 15th

Don't miss this extended deadline - ensure your director compliance without fees

👉 Get KYC Filing AssistanceWho Needs to File DIR-3 KYC?

The DIR-3 KYC requirement applies to all directors who have been allocated a Director Identification Number (DIN). Here's who needs to file:

- All Active Directors: Directors of companies registered under the Companies Act

- New DIN Allottees: Directors who obtained DIN in the previous financial year

- Annual Requirement: Directors who need to update their KYC details annually

- Non-Compliant Directors: Those who missed previous KYC filing deadlines

- Foreign Nationals: Foreign directors of Indian companies